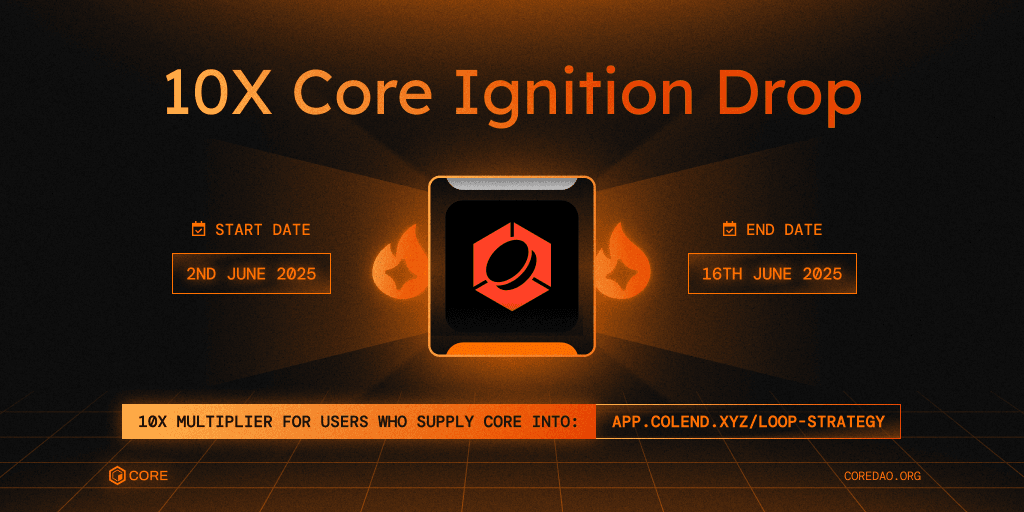

The latest Ignition campaign on Core has launched, bringing yield strategies that are accessible, efficient, and community-driven.

What Is Colend?

Colend is the first native lending and borrowing protocol on the Core blockchain, designed to unlock the power of BTCfi through decentralized, non-custodial liquidity markets. Whether you're supplying assets to earn yield or borrowing against your collateral, Colend offers a seamless and secure way to engage in DeFi on Core.

Colend x Core's newest loop campaign on Ignition leverages CORE deposits in a sophisticated looping strategy that amplifies yield while maintaining security through Core's robust infrastructure. This campaign is designed for users who want to maximize their CORE holdings while contributing to the growth of Core's DeFi ecosystem, bringing institutional-grade yield strategies to retail investors.

Campaign Overview

Users who deposit CORE into Colend's looping vault from the campaign launch will earn 10x Sparks multipliers. This is a rare chance for users to maximize yield with low friction while supporting Core's DeFi ecosystem.

Multiplier Details

✅ 10x Multiplier - 10x multiplier for users who provide CORE asset into Colend's looping vault

The 10x multiplier will be applied to all the TVL contributed to the vault. These multipliers significantly boost your share of Core's Ignition sparks — an opportunity you don't want to miss.

How to Participate (Step-by-Step)

To receive a 10x multiplier for depositing CORE into the LOOP strategy CORE-stCORE on Colend:

- Get an Ignition Account ➤ Go to ignition.coredao.org

- Visit Colend ➤ Head to app.colend.xyz/loop-strategy/

- Connect Your Wallet ➤ Ensure you're connected to Core network

- Choose "x LOOP" Vault ➤ Select the looping strategy option

- Enter Amount for "CORE" Asset ➤ Deposit your desired CORE amount

- Click "Deposit" ➤ Confirm the transaction and start earning

Understanding the Looping Strategy

What Constitutes One Loop?

One loop in the looping feature involves the following steps:

- Borrow CORE

- Mint stCORE

- Deposit stCORE

Expected APY by Loop Count

The estimated lower and upper bounds of the annual percentage yield (APY), based on the number of leverage loops executed, is ~7.42% to ~14.44%.

1x loop: ~7% APY

2x loop: ~10% APY

3x loop: ~12% APY

4x loop: ~14% APY

Maximum number of loops allowed: 4

Example: 4x Looping Flow

Here's an example of a 4x looping flow, starting with 100 CORE:

- Mint stCORE with 100 CORE

- Deposit stCORE as collateral

- Borrow 42 CORE

- Mint stCORE

- Deposit stCORE (Loop 2)

- Borrow 25 CORE

- Mint stCORE

- Deposit stCORE (Loop 3)

- Borrow 10 CORE

- Mint stCORE

- Deposit stCORE (Loop 4)

- Borrow 4 CORE

- Mint stCORE

- Deposit stCORE

This example illustrates the iterative process of borrowing, minting, and depositing stCORE to achieve a 4x loop.

Why Join Colend's Ignition Campaign?

Maximum Efficiency: Automated looping strategies optimize your CORE yield

User-Friendly: Simple deposit process, no complex DeFi management required

High Reward Potential: 10x Sparks multipliers available for active participants

Capital Efficient: Your CORE works harder through intelligent strategy automation

Core Native: Built specifically for Core's ecosystem and community

Proven Strategy: Looping mechanisms are battle-tested in DeFi

Join the Movement

This campaign isn't just for DeFi degens. It's for the everyday CORE holder, the Core community, and anyone seeking to grow their crypto stack efficiently.

The campaign is live now — don't miss your window to maximize rewards.

🔗 Start here: ignition.coredao.org

🌐 Deposit now: app.colend.xyz/loop-strategy/

Smart yield. Real rewards. Powered by Core.

Want to dive deeper into BTCfi? Explore tutorials, updates, and deep dives on Core's blog and Core Academy — the easiest way to explore Bitcoin DeFi.

Important Risk Disclaimer

A looping strategy in lending and borrowing involves borrowing against collateral and then re-lending or re-investing the borrowed assets to maximize returns. However, this approach carries risks.

Stay informed about Core, stCORE, and Colend updates. Monitor your health factor regardless of your strategy.

This information is for educational purposes only and should not be considered investment advice. Always conduct your own research and consult with financial experts before investing in any product or strategy. Cryptocurrency investments carry inherent risks, and you should carefully evaluate the risks and rewards before making any investment decisions.

🔗 Website | Twitter (X) | Telegram | Discord | YouTube | LinkedIn | Newsletter