Seven major launches in two weeks. Gaming metrics up significantly. Native stablecoins with institutional backing. AI-powered smart vaults going live.

From VaultLayer's launch to BITS Financial's new yield primitive, the past two weeks delivered a cascade of infrastructure upgrades for Core. With Ignition ending and Core Missions beginning, the ecosystem is transitioning from initial growth to sustained momentum.

Let's dive in 👇

⭐ Wins

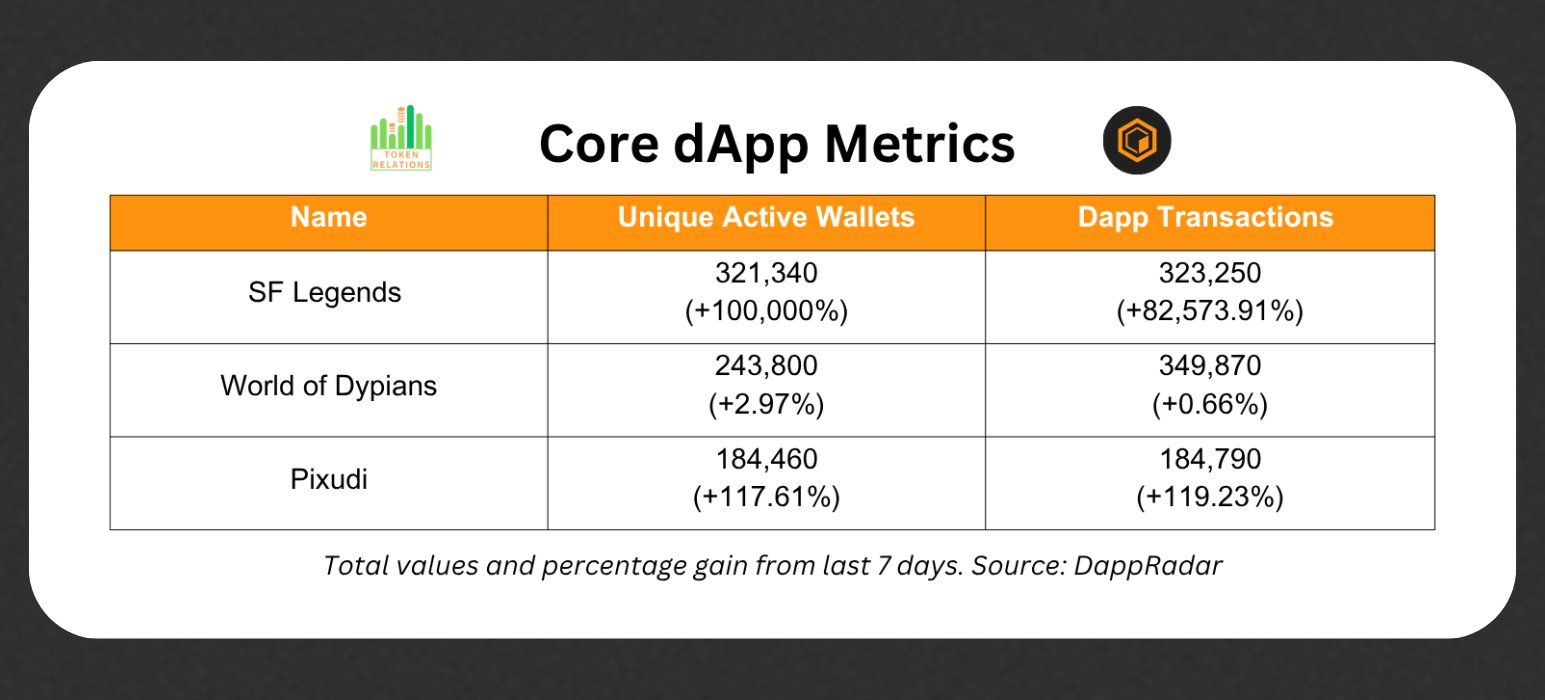

Gaming Metrics Reach New Heights

SF Legends recorded strong growth with 321,340 unique active wallets (+100,000%) and 323,250 transactions (+82,573.91%) according to DappRadar. Pixudi and World of Dypians also showed strong gains, with Pixudi up 117.61% in wallets and 119.23% in transactions.

GweNw4VWQAAleDM.jpeg

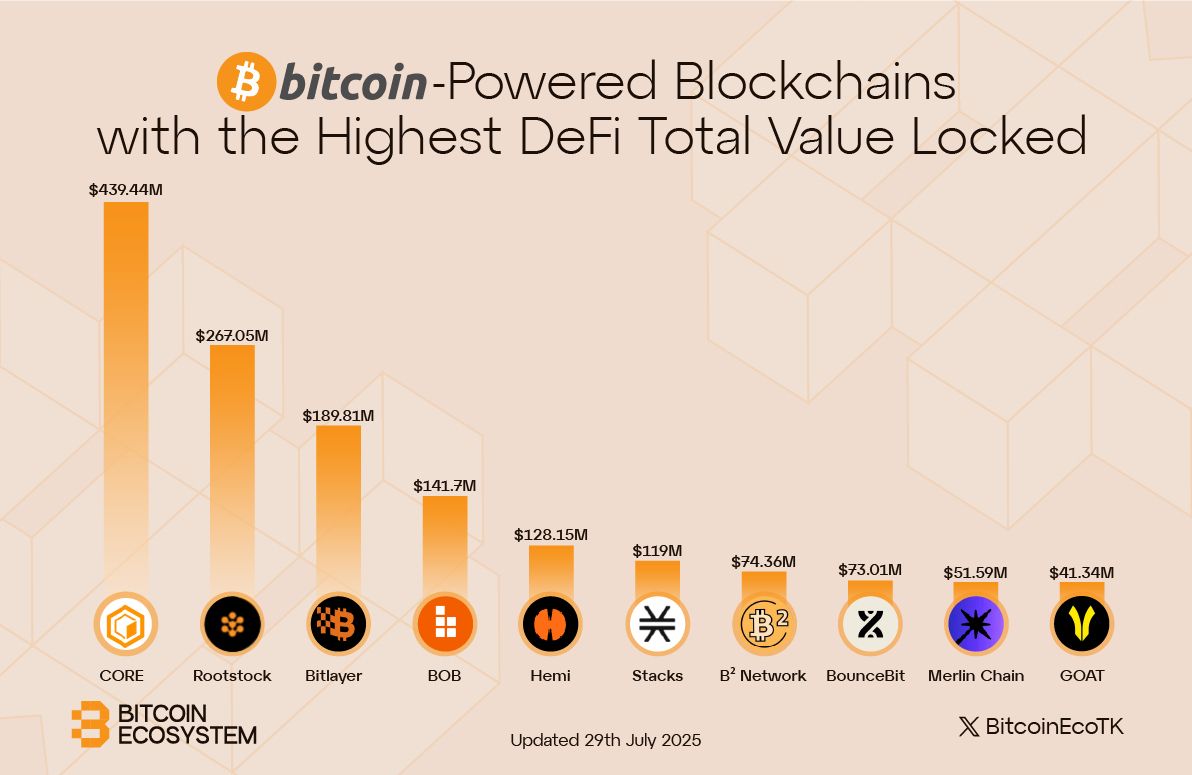

Core Maintains #1 TVL Position

Bitcoin Ecosystem data shows Core leading all Bitcoin-powered blockchains in DeFi TVL at $439.44M ($386.95M as of today), ahead of Rootstock ($267.05M) and Bitlayer ($189.81M). Core maintains its TVL lead in the BTCfi space.

GxBoYEvbgAAD2N8.jpeg

Core's Security Reaches 88%+ of Bitcoin's Hash Rate

88%+ of Bitcoin's hash rate now secures the Core blockchain, with 812 EH/s out of Bitcoin's total 920 EH/s. The road to 100% continues.

📣 Announcements / Launches

Molten Finance: Liquidity Hub for BTCfi

Molten launched as a Super DEX powering deep, low-slippage swaps across BTC wrappers, LSTs, stables, and more. Built specifically for BTCfi, it serves as the liquidity engine for Bitcoin DeFi with features for trading, LP provision, and yield earning on BTC-backed assets.

Volta Market: 250x Bitcoin Leverage

Volta Market launched as a native perpetuals DEX built for CORE and BTC trading, offering 250x leverage with zero slippage and fully on-chain execution. Users can now stay BTC-backed and BTC-denominated while earning from the VLP Vault.

BITS Financial: New Bitcoin Yield Primitive

BITS went live turning idle BTC into a liquid, composable ERC-20 asset earning 2.4-5% APY. With institutional custody, real counterparties, and full composability, $BITS enables non-dilutive yield on $BTC and $WBTC deposits.

AUSD Native Stablecoin Goes Live

Core's first native stablecoin AUSD launched, managed by VanEck and custodied by State Street. This fully collateralized stablecoin (backed 1:1 by USD cash, U.S. treasuries, and overnight repo agreements) reduces dependency on bridged stablecoins while providing income to the ecosystem through Rev+. Proven at scale with $10B+ transaction volume and 1M+ transfers processed.

VaultLayer Launches with AI Agents and Smart Vaults

VaultLayer went live on Core, introducing AI agents and Smart Vaults for Self-Custodial Bitcoin Staking. The platform turns every staked BTC position into something users can borrow against, automate, or optimize.

Fiamma Bridge: First Trust-Minimized Bitcoin Bridge

Fiamma Bridge mainnet launched as the first trust-minimized Bitcoin bridge powered by BitVM2, now live across 11 chains including Core. This introduces trust-minimized bridging for Bitcoin interoperability.

Core Ventures Launches BTC-FI Accelerator

Core Ventures introduced BTC-FI, a flagship accelerator for teams building the next era of staking, yield, and liquidity on Core. The 14-week remote program offers up to $100K funding, hands-on guidance from top-tier operators and investors, and direct access to Core's ecosystem.

From Ignition to Precision: Core Missions

Ignition is ending and Core Missions are beginning, shifting focus to sustained ecosystem development with user-centric features. This transition represents Core's evolution from initial growth campaigns to sustained ecosystem development.

🎙️ Events & Recaps

Bitcoin Fusion Webinar: Bitcoin x Stablecoins

Core hosted a Bitcoin Fusion webinar featuring Hong Sun (Core), Paul Kremsky (Cumberland), Sam Bourgi (Cointelegraph), Sid Sridhar (WMA), and Brighid Quirke (Agora Finance) discussing how Bitcoin and stablecoins are shaping the future of on-chain finance.

Core SZN Spaces Series Launches

Core kicked off a new bi-weekly X Spaces series covering the latest dApps, biggest launches, and upcoming developments. The first episode "New Dapps Everywhere" featured Core contributors discussing the ecosystem's rapid expansion.

Dev Rel Office Hours Begin

Core Builders launched bi-weekly DevRel Office Hours that started July 29th, offering 1:1 mentorship for builders. Developers can bring questions, code, or visions for debugging, refining, and growth support.

💡 Media Coverage

Hong Sun: "Bitcoin is the New Real Estate"

Token Relations featured Core's Initial Contributor Hong Sun discussing how institutions are eyeing Bitcoin yield opportunities as Bitcoin transitions from passive store of value to productive asset.

Rich Rines on Institutional Bitcoin Adoption

Rich Rines spoke with Crypto Daily UK about ETF surges and corporate Bitcoin treasury adoption, explaining how institutions are starting to look for Bitcoin yield as the next evolution in BTC capital deployment.

📈 What's Next

With seven major dapp launches in July alone and more coming, Core's infrastructure buildout continues at pace. The combination of gaming growth, institutional-grade yield products, and enhanced liquidity infrastructure positions Core to capture the growing demand for Bitcoin productivity.