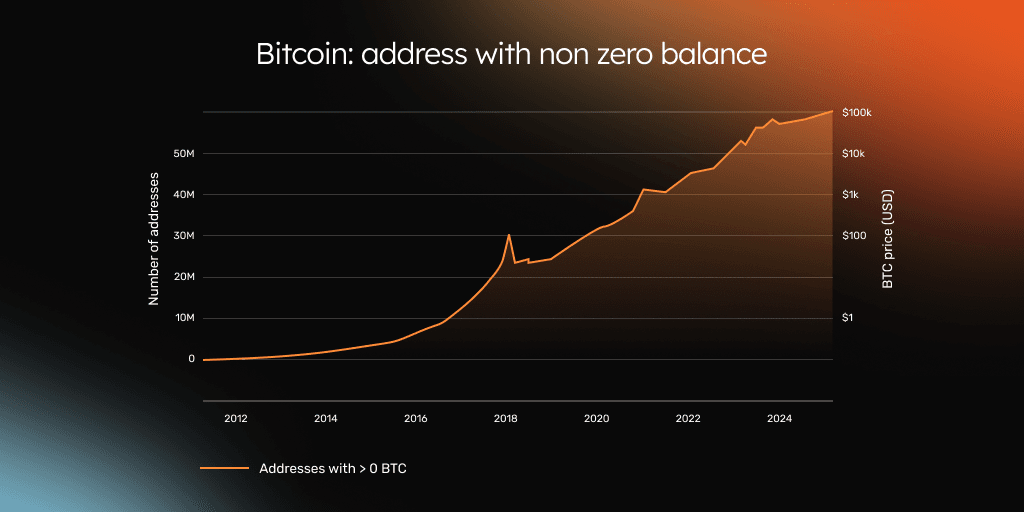

With ~700 million global cryptocurrency owners as of April 2025 and Bitcoin with a 58.8% dominance and a $2.3 trillion market cap, and over 54.8 million addresses with non-zero balance, the evolution of digital finance is no longer a trend; it's a transformation. Bitcoin, once a cryptographic experiment, has evolved into a geopolitical force, adopted by nations, held by Fortune 500 companies, and integrated into the strategies of sovereign funds.

As adoption accelerates, one idea grows increasingly inevitable: hyperbitcoinization — a future where Bitcoin becomes the default financial layer of the world.

But to reach that future, Bitcoin must evolve. It must become more than a store of value. It must transform into a medium of exchange, a programmable financial asset, and a gateway to decentralized finance.

This is the mission of Core, the first end-to-end proof-of-stake Layer-1 built for Bitcoin. As the most Bitcoin-aligned blockchain, Core is fully EVM-compatible, secured by Bitcoin hash power, and economically integrated with the BTC asset. It brings scalability, composability, and interoperability to Bitcoin, without compromising decentralization.

Core is not just complementary to Bitcoin; it is an accelerant for its global rise, building the infrastructure necessary for a Bitcoin-powered financial system, and laying the foundation for hyperbitcoinization.

What is Hyperbitcoinization

Hyperbitcoinization envisions a future where Bitcoin transcends its role as a digital store of value to become the primary global financial standard, supplanting fiat currencies as the default medium of exchange, unit of account, and store of value.

In essence, a hyperbitcoinized world is one where everything is priced in sats, eliminating the need for trust in central banks and positioning Bitcoin as the operating system of global finance.

How is Core facilitating hyperbitcoinization - Graphic 3.png

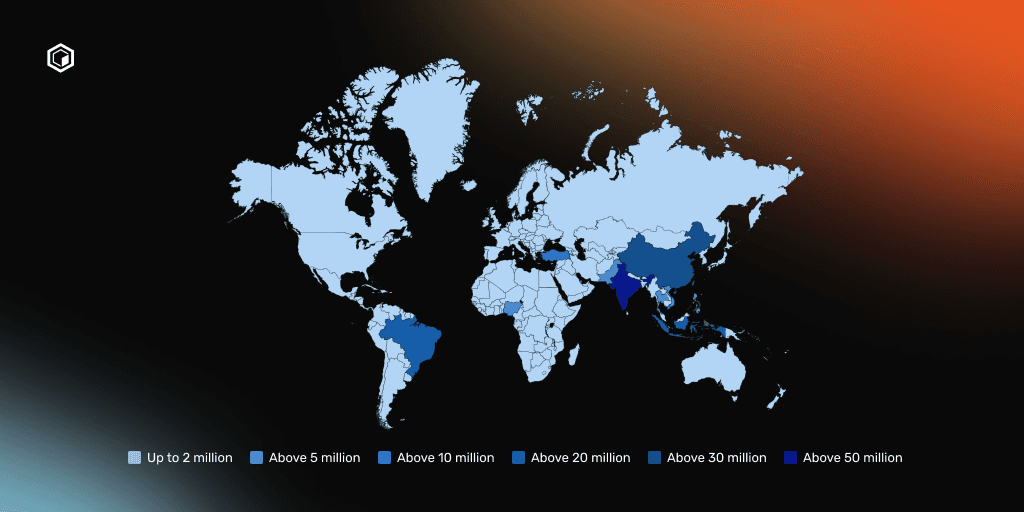

Figure: Heatmap Chart illustrating Bitcoin Adoption by Country as of July 2024 (Source)

This scenario is not merely speculative; it's increasingly plausible, driven by Bitcoin's unique attributes:

A hard-capped supply of 21 million BTC ensures inherent scarcity, hedging against inflation and currency debasement.

Its decentralized and permissionless nature allows it to operate independently of governmental or institutional control.

Being borderless and open, Bitcoin empowers anyone with internet access to participate in a neutral financial system.

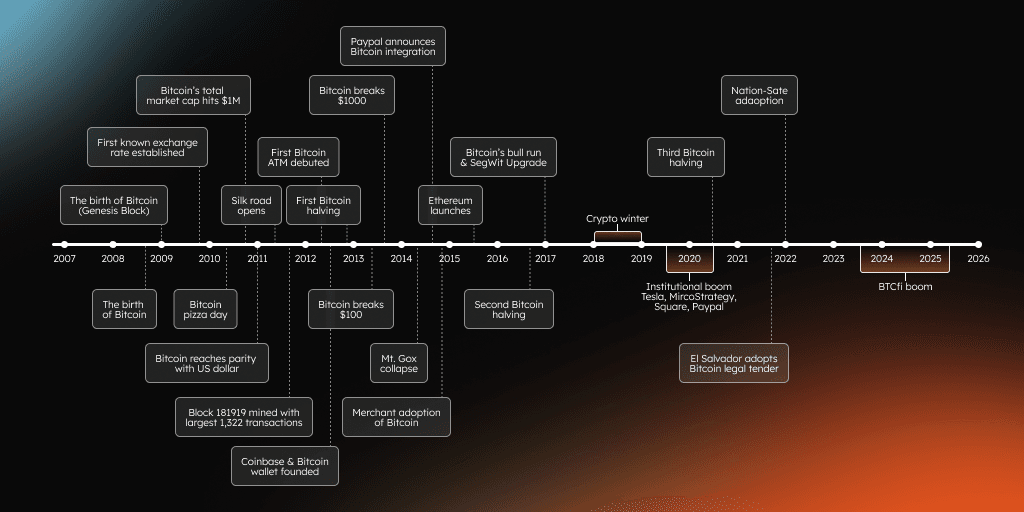

How is Core facilitating hyperbitcoinization - Graphic 1.png

Figure: A simple timeline or infographic showing the evolution of Bitcoin from its inception to the current stage

Across the world, governments and institutions are taking active steps toward integrating Bitcoin, not just as an asset, but as part of national and corporate financial strategy.

National Reserves and Public Sector Adoption

El Salvador adopted Bitcoin as legal tender in 2021 and continues to grow its national reserve, holding over ~6,111 BTC as of March 2025.

Bhutan has strategically leveraged its hydroelectric resources to mine Bitcoin, accumulating over 13,000 BTC in 2024, constituting approximately 28% of its GDP. The nation utilizes these holdings to fund government operations and stimulate economic growth. The current holdings are 11,286 BTC in July 2025.

Brazil is witnessing corporate interest in Bitcoin as a reserve asset. Fintech company Meliuz seeks shareholder approval to designate Bitcoin as a primary strategic asset within its treasury.

The Czech Republic is exploring the inclusion of Bitcoin in its national reserves, with proposals suggesting an allocation of up to 5% of its €140 billion reserves to Bitcoin.

United States: Becoming a Leading Voice Leading on All Fronts

In March 2025, an executive order established a U.S. Strategic Bitcoin Reserve to consolidate government-owned BTC; analysts estimate ~200,000 BTC across federal holdings, as referenced in the policy debate.

Arizona enacted a Bitcoin & Digital Assets Reserve Fund for unclaimed crypto (May 2025) while vetoing a separate bill that would have allowed investing up to 10% of state funds in crypto. New Hampshire passed a distinct reserve-style measure.

Corporate treasuries are also rapidly embracing Bitcoin:

MicroStrategy leads with 628,946 BTC, reaffirming its commitment to Bitcoin as a primary treasury reserve.

Marathon Digital Holdings (MARA) holds over 50,639 BTC, emphasizing Bitcoin’s role in a future-proofed treasury strategy.

GameStop (GME) holds 4,710 BTC after approving BTC as a treasury reserve asset in March 2025.

Europe: Growing Institutional Consideration

Sweden’s parliament is reviewing a proposal to include Bitcoin in the country's national reserves, citing inflation hedging and monetary sovereignty.

The Czech National Bank is evaluating Bitcoin’s utility through a test portfolio pilot.

While the European Central Bank remains skeptical, individual EU nations openly explore decentralized alternatives to fiat-based reserves.

These developments reflect a profound global revaluation of Bitcoin, not as a fringe asset, but as a resilient monetary base for sovereign economies and forward-looking institutions. However, for hyperbitcoinization to materialize, Bitcoin must overcome certain inherent limitations with its infrastructure:

Scalability: Enhancing transaction throughput to accommodate global usage.

Programmability: Enabling complex financial operations beyond simple transfers.

Interoperability: Ensuring seamless integration with diverse financial systems and applications.

How is Core facilitating hyperbitcoinization - Graphic 2.png

Figure: Adoption curve of Bitcoin over time, count of addresses with non-zero balance

This is where Core becomes an invaluable accelerant. Built as Bitcoin's complementary smart contract platform, Core is uniquely positioned to accelerate hyperbitcoinization by addressing Bitcoin's limitations, without compromising its values.

Core's Role in Facilitating Hyperbitcoinization

Core is built with a simple yet transformative mission: to unlock over $2.4 trillion in idle Bitcoin capital and integrate it into a high-yield, decentralized, and globally accessible financial system. By doing so, the goal is to lay down the rails for positioning Bitcoin as a medium of exchange, a productive asset, and ultimately the default financial layer of the world.

Satoshi Plus: The Counterpart to Nakamoto Consensus

At the heart of Core lies Satoshi Plus consensus, a novel hybrid mechanism that combines Delegated Proof of Work (DPoW), Delegated Proof of Stake (DPoS), and Self-Custodial BTC Staking into a unified security and governance framework.

This model brings together three distinct participant groups:

- Bitcoin miners, who delegate hash power to secure the network and earn rewards without leaving the Bitcoin ecosystem

- Bitcoin holders, who stake their BTC self-custodially to earn native yield while retaining full ownership

- CORE holders, who participate in consensus via Delegated Proof of Stake

Together, they elect a decentralized validator set that secures the Core blockchain, creating a robust system backed by significant economic capital and real Bitcoin security.

More than a technical breakthrough, Satoshi Plus is a strategic leap toward hyperbitcoinization. It reduces barriers to participation, introduces new financial incentives for Bitcoin stakeholders, and unlocks robust infrastructure for Bitcoin to function as a global, decentralized financial standard.

Scalability That Meets Real-World Demands

The Core blockchain is designed to overcome the transaction limitations of the Bitcoin network, particularly its low throughput and high latency. By integrating DPoS, it significantly enhances transaction throughput and substantially reduces latency. Core blockchain is also designed to ensure rapid block finality, approximately 3 seconds, compared to Bitcoin's 10-minute block time.

This architecture supports:

High-volume applications, like retail payments or DeFi trading

Instant user experiences, with low fees and low congestion risk

Institutional-grade performance, on a decentralized foundation

Core enables Bitcoin to transcend its role as digital gold, evolving into programmable money that can scale with the modern economy.

Secure, Self-Custodial Bitcoin Staking: Native Yield Without Compromise

Core is the first blockchain to offer a live, self-custodial Bitcoin staking mechanism. This innovation empowers BTC holders to convert idle capital into native yield without relinquishing custody or introducing new trust assumptions. It leverages Bitcoin's own scripting capabilities, combining its security and decentralization with the utility and returns of DeFi.

Built on Bitcoin's Security

In traditional staking or DeFi protocols, users often forfeit control of their assets to third-party custodians. Core takes a different path. With Self-Custodial BTC Staking, Bitcoin remains in the user's wallet, under their control, and on the Bitcoin network.

This is made possible through Bitcoin's CheckLockTimeVerify (CLTV) opcode. This timelock script ensures BTC cannot be moved until a specific block height is reached, ensuring that the locked Bitcoin assets are accessible only to the owner. Core's staking contracts utilize this feature to lock BTC natively, enabling:

Secure delegation to validators

CORE token rewards for BTC stakers

Zero custodial risk throughout the process

No wrapping or bridging of BTC

Core's staking model aligns most with Bitcoin's ethos: trustless, secure, and self-sovereign.

Dual Staking: Yield Amplified, Capital Unified

Core introduces Dual Staking as an enhancement to its Self-Custodial BTC Staking, offering higher rewards to participants who stake both BTC and CORE simultaneously, creating more substantial economic alignment between the two assets.

Hyperbitcoinization Through Native Yield

Core's Self-Custodial Bitcoin Staking contributes to the long-term vision of hyperbitcoinization in several ways:

Increased Utility: Enabling BTC holders to generate yield without sacrificing security or self-custody makes Bitcoin more attractive for both individual investors and institutions.

Financial Incentives: Bitcoin holders who might otherwise passively hold their BTC can now put it to work, earning additional rewards while benefiting from Bitcoin's long-term price appreciation. This makes Bitcoin more appealing, even to those who primarily seek financial returns, thus expanding the base of Bitcoin users.

No Added Trust Assumptions: One of the primary drivers behind Bitcoin's push toward hyperbitcoinization is its decentralized nature, eliminating the need for trust in intermediaries. Self-custodial staking aligns perfectly with this by allowing users to participate in the network's security and governance without relying on centralized entities.

Trustless Financial System: The concept of a trustless financial system is at the heart of hyperbitcoinization. Self-Custodial BTC staking eliminates the need for trusting intermediaries, keeping Bitcoin aligned with the ethos of decentralized finance.

Strengthening Bitcoin's Position: As more people opt for Self-Custodial solutions, reliance on centralized financial systems (including banks and custodial services) decreases. This shift strengthens Bitcoin's position as a fundamental part of a global, decentralized financial network.

Institution-Ready Infrastructure: Through integrations with trusted custodians like BitGo, Copper, and Cactus Custody, Core enables institutions to participate in Bitcoin-native staking directly from secure custody, unlocking compliant, yield-generating strategies at scale without sacrificing decentralization. This bridges the gap between traditional finance and Bitcoin DeFi, making BTC not just held, but used — a crucial step toward hyperbitcoinization.

As more BTC holders transition from holding to staking, Core is enabling a global financial shift—one in which Bitcoin is not just a store of value but the trustless economic engine powering decentralized finance.

Institution-Ready: Enabling Secure, Scalable Bitcoin Yield at Enterprise Scale

Core’s infrastructure is purpose-built for institutional adoption. Through integrations with leading custodians and asset managers, including BitGo, Copper, Cactus Custody, and Maple Finance, institutions can participate in Bitcoin-native staking without compromising custody, compliance, or operational security.

The Core ecosystem recently took another major step forward with the launch of the Core app on Ledger Live. This integration enables users to Clear Sign Bitcoin timelock transactions directly from their Ledger devices, allowing them to earn rewards via Core’s Self-Custodial BTC Staking mechanism. It’s a milestone that combines yield generation with hardware-level self-custody, ensuring Bitcoin holders can unlock returns without sacrificing security or sovereignty.

Together, these integrations give institutional clients the ability to:

Stake BTC directly from cold storage or segregated custody accounts.

Participate in Dual Staking (BTC + CORE) while maintaining regulatory alignment.

Access BTC-denominated yields with transparent, on-chain validation.

Bypass the risks of wrapped assets, synthetic derivatives, or custodial rehypothecation.

The Impact of Core's Contribution to Bitcoin Adoption

Lowering Barriers to Bitcoin Adoption

Core's highly scalable architecture, powered by the Satoshi Plus consensus, addresses the long-standing limitations of the Bitcoin base layer. With transaction finality in under three seconds, high throughput, and ultra-low fees, Core transforms Bitcoin from a slow, passive store of value into a viable medium of exchange. This sets the stage for Bitcoin to be usable in high-frequency, real-world environments, such as microtransactions, commerce, and DeFi.

At the same time, Core's seamless EVM compatibility enables developers to build advanced applications leveraging the security of Bitcoin, such as lending, borrowing, trading, and yield generation. By empowering Bitcoin with smart contract programmability and DeFi composability, Core opens the door for a broader range of users to interact with BTC beyond holding and trading.

Facilitating Institutional Adoption

Institutions demand secure, regulated, and compliant infrastructure, and Core delivers just that. Core is integrated with top custodians, including BitGo, Copper, and Cactus Custody. This enables institutions to safely stake Bitcoin through self-custodial flows without transferring funds or exposing them to counterparty risks.

Core's robust infrastructure, combined with self-custodial staking, Dual Staking, and institutional-grade security protocols, creates a Bitcoin-native yield product that aligns with the operational standards of hedge funds, treasuries, sovereign wealth funds, and family offices.

Real-World Institutional Traction

Core is already witnessing meaningful traction among institutional players:

In June 2024, the Core Foundation and Valour, a subsidiary of DeFi Technologies, launched the world's first yield-bearing BTC ETP, offering a 5.65% return via Core's Self-Custodial Bitcoin Staking.

Pathway to a Bitcoin Yield ETF: Core is well-positioned to become the infrastructure underlying the first U.S.-based Bitcoin Yield ETF

CoreFi Strategy by DeFi Technologies: Modeled after high-conviction treasury strategies, such as MicroStrategy, CoreFi Strategy offers institutions a regulated, leveraged path to earn native BTC yield and gain high-beta exposure to CORE, the native asset of the Core blockchain and the foundation of the BTCfi ecosystem.

This convergence of innovation and credibility is already yielding results: over $534 million in BTC has been staked with Core, representing a growing class of institutional capital that is converting Bitcoin into a productive treasury asset.

Core facilitates trust and usability, making Bitcoin more appealing to both everyday users and large-scale institutions and driving it closer to widespread mainstream adoption.

Conclusion

The journey toward hyperbitcoinization is no longer speculative—it's unfolding in real time. As Bitcoin gains momentum globally as a sovereign reserve asset and a corporate treasury hedge, one challenge remains: turning Bitcoin from passive digital gold into an active, yield-generating, and programmable financial foundation.

Core is the answer to that challenge.

By addressing Bitcoin's core limitations—scalability, programmability, and composability—Core is transforming the world's most secure monetary network into a dynamic engine for decentralized finance.

With Satoshi Plus, Core introduces a new consensus mechanism that merges hash power, staking, and self-custodial security into a single, unified protocol.

EVM compatibility unlocks smart contract functionality, making Bitcoin composable, interoperable, and programmable across DeFi.

Innovations such as Self-Custodial BTC Staking and Dual Staking enable BTC holders to earn native yield while retaining complete control over their assets.

With institutional infrastructure, Core integrates with BitGo, Copper, and Maple Finance to make Bitcoin-native staking available to pension funds, asset managers, sovereign wealth funds, and crypto-native firms.

With CoreFi Strategy, institutions are gaining a structured and regulated pathway to deploy capital into BTC and CORE, modeled after successful treasury strategies, such as MicroStrategy.

Core isn't just building tools. It's laying down the financial rails for the Bitcoin economy—tools that allow both individuals and institutions to do more with their BTC: to earn, build, transact, and govern.

With significant BTC already staked, a growing DeFi ecosystem, live institutional products such as the first yield-bearing Bitcoin ETP, and pathways towards a yield-bearing Bitcoin ETF, Core is achieving what no other chain has: aligning deeply with Bitcoin's security and values while expanding its functionality and real-world impact.

Hyperbitcoinization isn't a distant vision. It's a destination, and Core is becoming the road to get us there.