Bitcoin staking, or Timelocking, lets BTC holders earn yield while keeping full custody of their assets. With Core’s Self-Custodial Bitcoin Staking, you can put your Bitcoin to work without relying on third parties or taking on counterparty risk—unlike lending platforms that require you to give up control.

Core’s Satoshi Plus Consensus makes this possible by integrating Bitcoin staking directly into network security. No wrapping, no intermediaries—just time-locked BTC securing the blockchain and earning CORE token rewards. Whether you're a long-term HODLer or looking to maximize your holdings, staking Bitcoin on Core is the safest way to put your BTC to work.

What Is Bitcoin Staking?

Bitcoin’s design doesn’t include native staking, but Core has changed that. With Self-Custodial Bitcoin Staking, BTC holders can earn yield while keeping full control of their assets—no wrapping, no lending, no intermediaries.

This method allows Bitcoin to secure Core’s blockchain through time-locked contracts, ensuring both security and rewards. Unlike lending platforms that introduce counterparty risk, Core’s staking keeps BTC safe in your wallet while generating passive income.

How Does Self-Custodial Bitcoin Staking Work?

Built for Security – Core’s Satoshi Plus Consensus enables Bitcoin staking without intermediaries, directly contributing to network security.

No Wrapping, No Risk – Your BTC remains on the Bitcoin blockchain—no bridging, no tokenized versions, no third-party custody.

Time-Locked Yield – Stakers commit BTC through hash time-locked contracts (HTLCs) for a fixed period, securing Core and earning CORE token rewards.

Benefits of Staking (Timelocking) Bitcoin on Core

Staking Bitcoin on Core turns your BTC into a productive asset without sacrificing security or control. Unlike traditional staking models, Core’s Self-Custodial Bitcoin Staking keeps your BTC in your wallet while securing the network and generating rewards.

Earn Passive Yield – Put idle BTC to work and earn CORE token rewards.

Full Custody – Your Bitcoin never leaves your wallet—no reliance on third parties.

No Slashing Risks – Unlike PoS staking, there are no penalties for downtime or validator failures.

Institutional-Grade Security – Combines Bitcoin’s proven security with Core’s decentralized staking model.

How To Stake Bitcoin on Core in 3 Easy Steps

1️⃣ Visit the Staking Portal

Go to stake.coredao.org and connect your Bitcoin wallet (e.g., Xverse, Unisat)

image2.png

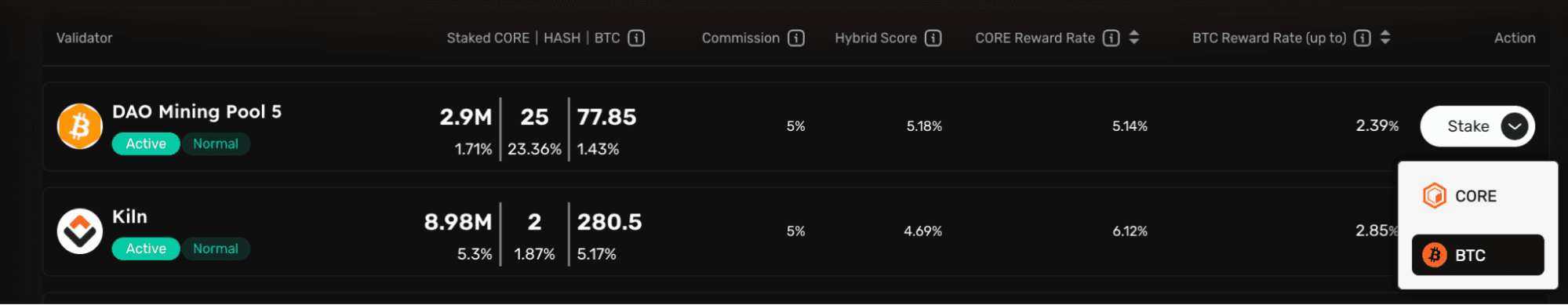

2️⃣ Choose a Validator

Select the Validator tab at the top

Validators secure the network—select one based on:

Hybrid Score (higher score = stronger contribution to security)

Commission Rates (lower fees mean higher returns for you)

Staking Rewards (some validators offer higher return rates)

Choose a validator and click Stake, then click BTC

3️⃣ Set Your Staking Amount & Lock Duration

Choose how much BTC you want to stake and confirm the staking transaction

Your Bitcoin remains in your wallet under a time-lock contract, and you start earning CORE rewards

Dual Staking: Boost Your Bitcoin Yield

Dual Staking lets BTC holders maximize their yield by staking both Bitcoin and CORE tokens. The more CORE staked alongside BTC, the higher the APY, making it the most rewarding way to stake Bitcoin on Core.

Higher Yield Potential – Combining BTC and CORE staking unlocks premium Bitcoin staking rates.

Simple Mechanism – Stake more CORE per BTC to move up in yield tiers.

Dual Staking Tiers:

Base Tier – (BTC only or less than 3,000 CORE per 1 BTC).

Boost Tier – 3,000 CORE per 1 BTC.

Super Tier – 9,000 CORE per 1 BTC.

Satoshi Tier – 24,000 CORE per 1 BTC.

Start Dual Staking – Unlock top-tier Bitcoin staking rewards today.

What’s Next? Start Staking Bitcoin Today

Staking Bitcoin on Core is the safest way to earn yield while keeping full control of your assets. Whether you choose Self-Custodial Bitcoin Staking (Timelocking) or maximize rewards with Dual Staking, your BTC is always secure and working for you.

Get started today—stake your Bitcoin, earn rewards, and help secure Core’s decentralized network. Visit stake.coredao.org to begin.

Want to dive deeper into BTCfi?

Explore tutorials, updates, and deep dives on Core’s blog and Core Academy — the easiest way to explore Bitcoin DeFi.

🔗 Website | Twitter (X) | Telegram | Discord | YouTube | LinkedIn | Newsletter