The world’s most secure and valuable cryptocurrency, Bitcoin, has historically been a passive store of value. Core, the first and only end-to-end Proof of Stake layer for Bitcoin, introduced Self-Custodial Bitcoin Staking in April 2024 to transform Bitcoin into a yield-generating asset while ensuring that users retain complete control over their funds.

While Self-Custodial Bitcoin Staking introduced the base Bitcoin staking rate, Dual Staking introduces enhanced Bitcoin staking yields to stakers of both Bitcoin and CORE tokens. This increases the utility of the CORE token in addition to further aligning the Bitcoin and Core communities. In this blog, we’ll explore the inner workings and value propositions of Dual Staking for the Core ecosystem and its participants.

I. Revolutionizing Bitcoin Staking

I.I Brief History of Self-Custodial Bitcoin Staking on Core

The first of its kind, Core’s Self-Custodial Bitcoin Staking presents a novel option for Bitcoin holders looking to earn rewards while maintaining complete control over their assets. In contrast to conventional custodial platforms that pose new risks and asset ownership transfer issues, Core’s Bitcoin staking mechanism allows users to stake assets directly on the Bitcoin network, leveraging Bitcoin’s native features to ensure security without introducing additional trust assumptions.

Core’s Self-Custodial Bitcoin Staking addressed the growing demand for yield-generation mechanisms in the Bitcoin ecosystem, marking a shift toward decentralized finance (DeFi) opportunities for Bitcoin holders.

I.II Introducing Dual Staking

Dual Staking builds upon Core’s Self-Custodial Bitcoin Staking by unlocking higher reward tiers for Bitcoin stakers who also stake CORE alongside their Bitcoin. By incentivizing deeper engagement through increased rewards, Dual Staking strengthens the bond between Bitcoin stakers and Core, laying the foundation for a unified Bitcoin-Core community.

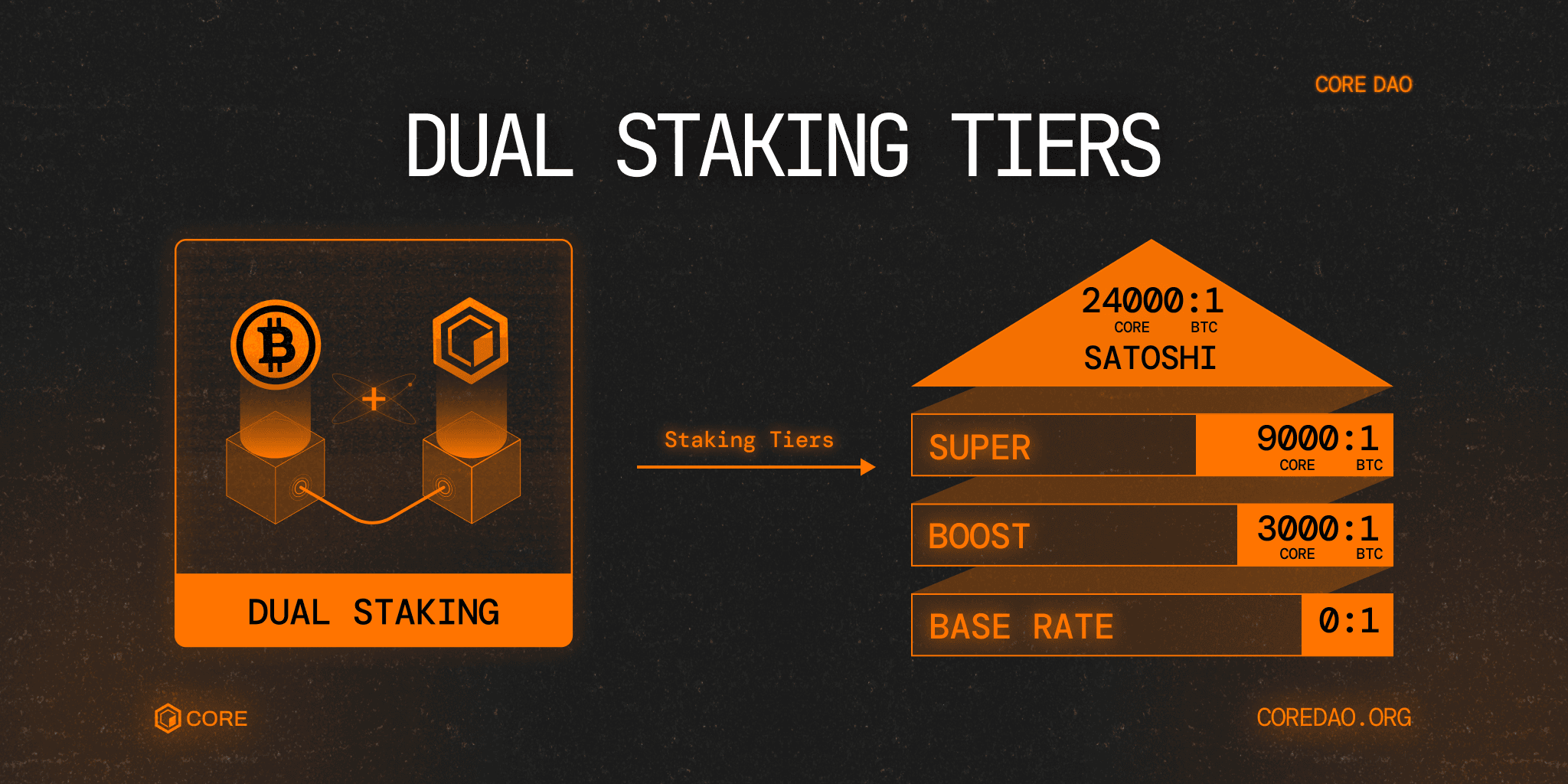

Dual Staking introduces a multi-tier system, where each tier defines a specific threshold of CORE-to-BTC staked ratio. The tier determines the percentage boost a user receives on their Bitcoin staking yield. This approach encourages Bitcoin stakers to make a deeper commitment to the Core ecosystem by maximizing yields for Bitcoin stakers who stake increasing volumes of CORE tokens. With Dual Staking, Bitcoin holders can turn rewards into compounding opportunities, maximizing both their Bitcoin and CORE holdings.

II. How Dual Staking Works

Dual Staking doesn’t change the fundamental staking process; users can still stake Bitcoin and CORE separately on Core. However, by staking both assets together, they unlock higher rewards on Bitcoin staking.

Dual Staking Tiers (7).png

Under the Dual Staking model, BTC stakers are divided into two categories:

- Base Stakers: Stakers who stake only BTC without any CORE. These users earn rewards at the base staking rate.

- Dual Stakers: Stakers who stake both BTC and CORE simultaneously, unlocking higher rewards based on their CORE-to-BTC staking ratio.

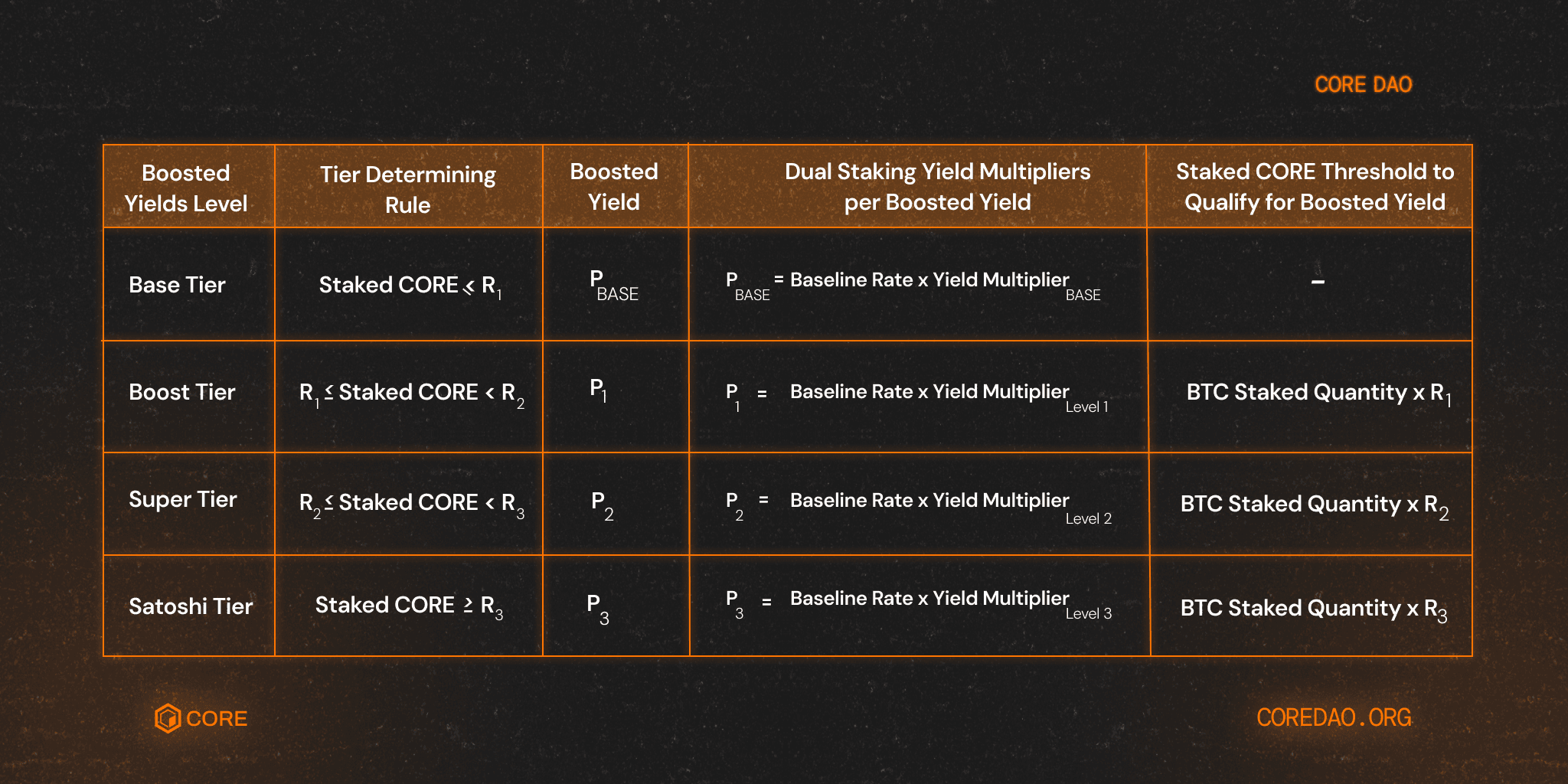

II.1 Boosted Yield Levels

Dual Staking introduces a tiered approach for rewards for Bitcoin staking on Core. In the current Dual Staking setup, Bitcoin staking rewards are segmented into multiple yield levels determined by the CORE-to-BTC staking ratio (R1, R2, R3, …, RMAX), representing the amount of CORE tokens staked relative to the amount of Bitcoin staked. These ratios directly influence the yield multipliers applied to the base rate of Bitcoin staking for each level. The yield levels are categorized as follows:

Level 0 (Base Level): This layer offers the default Bitcoin staking base rate for users who are staking Bitcoin only, without any boosted yield.

Boosted Yield Levels — Based on the CORE-to-BTC staking ratios (R1, R2, R3), users may qualify for higher reward rates. These higher levels are applied via yield multipliers that adjust the base rate for staking BTC:

- Level 1 (Boost Level): The Bitcoin staking base rate is multiplied by the Level 1 yield multiplier (based on R1).

- Level 2 (Super Level): The Bitcoin staking base rate is multiplied by the Level 2 yield multiplier (based on R2).

- Level 3 (Satoshi Level): The Bitcoin staking base rate is multiplied by the Level 3 yield multiplier (based on Rn).

Dual Staking Tiers (9).png

Key Notes:

Yield Multipliers: These are dynamically determined based on each user's staking data and the current Dual Staking settings.

Core Staking Thresholds: Specific thresholds of CORE staking must be met to qualify for these boosted yield levels.

Governance Adjustability: The staking ratios (R1, R2, R3) and the number of boosted yield levels are adjustable through governance votes, allowing for future modifications.

II.2 CORE-to-BTC Staking Rations

CORE-to-BTC rations, R1, R2, R3, decide the Bitcoin staker’s yield tier (Base, Boost, Super, or Satoshi), with R3 > R2 > R1. While staking ratios are subject to change, the CORE-to-BTC staking ratios as of 5/20/2025 are as follows:

Staking Ratio R1 = 3,000 CORE per 1 BTC

Staking Ratio R2 = 9,000 CORE per 1 BTC

Staking Ratio R3 = 24,000 CORE per 1 BTC

II.3 CORE Thresholds for Each Boosted Yield Level

Using the Staking Ratio (R), users can calculate the minimum CORE threshold for each boosted yield level (P) using the following formula:

Stake CORE threshold for = BTC Staked Quantity Staking Ratio R1

For instance,

CORE threshold for Level1 (Boost) = BTC Staked Quantity Staking Ratio R1

Determining Boosted Yield Levels

The boosted yield tiers can be easily calculated using the stake CORE amount and the staking ratio for a given user.

Dual Staking Tiers (6).png

The number of boosted yield levels and the staking ratios are adjustable through governance voting. Users can distribute their staked CORE and/or Bitcoin for maximum yield across multiple active Core validators.

Example Calculation

Let’s give a simple example to help you understand the Dual Staking multi-tier reward system better. Let’s assume a user has staked 65,000 CORE along with 10 BTC, with the staking ratios

Staking Ratio R1 = 2,000 CORE per 1 BTC

Staking Ratio R2 = 6,000 CORE per 1 BTC

Staking Ratio R3 = 16,000 CORE per 1 BTC

Then, the thresholds of Staked CORE for each boosted yield tier will be:

Staked CORE Threshold for Level 1 (Boost) = 10 2,000 = 20,000 CORE

Staked CORE Threshold for Level 2 (Super) = 10 6,000 = 60,000 CORE

Staked CORE Threshold for Level 3 (Satoshi) = 10 16,000 = 160,000 CORE

Following are the determining rules set for the boosted yield tier of the user

Level 0 (Base): if the amount of staked CORE is below 20,000

Level 1 (Boost): if the amount of staked CORE is above or equal to 20,000 but below 60,000

Level 2 (Super): if the amount of staked CORE is above or equal to 60,000 but below 160,000

Level 3 (Satoshi): if the amount of staked CORE is above or equal to 160,000

Since Rewards are distributed based on the participant’s CORE-to-Bitcoin ratio and the corresponding tier, the user, in our example, with 65,000 CORE staked along with 10 BTC, will enjoy the boosted yield from the Super tier. However, to enjoy rewards from the Satoshi tier, the user is recommended to stake a minimum of 160,000 CORE.

III. Dual Staking — A Win-Win for Everyone

CORE Holders/Stakers: Dual Staking enhances CORE’s utility by making it essential for unlocking higher Bitcoin staking yields.

Bitcoin Holders/Stakers: While Bitcoin stakers can continue to stake at the base staking rate, by also staking CORE tokens, they can access the highest rates available on Core.

IV. Conclusion

Dual Staking revolutionizes Bitcoin staking by unlocking higher yields and greater utility through the combined staking of Bitcoin and CORE. This innovative mechanism provides sustainable and scalable rewards while enhancing the security and growth of the Core blockchain. By aligning the Bitcoin and Core ecosystems, Dual Staking fosters deeper engagement and incentivizes long-term value creation.