Core Blockchain: Unlocking the Next Era of Bitcoin DeFi

Core’s growth in 2024 stands out as a powerful example of how a Bitcoin-driven ecosystem can redefine the landscape. This year alone, Core blockchain has taken big steps in broader ecosystem impact, with unique wallet addresses growing by 85%, more than 300 million transactions and nearly 8,000 BTC staked.

Core: Leading Bitcoin Sidechain in Key Metrics

Core is No 1 Bitcoin Sidechain

Ultimately, Core became the #1 Bitcoin sidechain during 2024 and Dylan Dennis, contributor at Core DAO is not surprised: “Core leads BTCfi in every conceivable metric, it also has fast block times and low transaction fees, and a suite of Bitcoin centric dApps.”

This explosive growth doesn't come without an explanation as there were several innovations brought to Core during the year. Rich Rines, Initial Contributor at Core says: “In April 2024, Core made History as the first blockchain to adopt a fully non-custodial Bitcoin staking product, introducing native yield to Bitcoin for the first time. By adding Bitcoin staking to Satoshi Plus consensus, Core has significantly strengthened Bitcoin DeFi security, especially as Core’s activity and total value locked (TVL) have surged with the emergence of key protocols.”

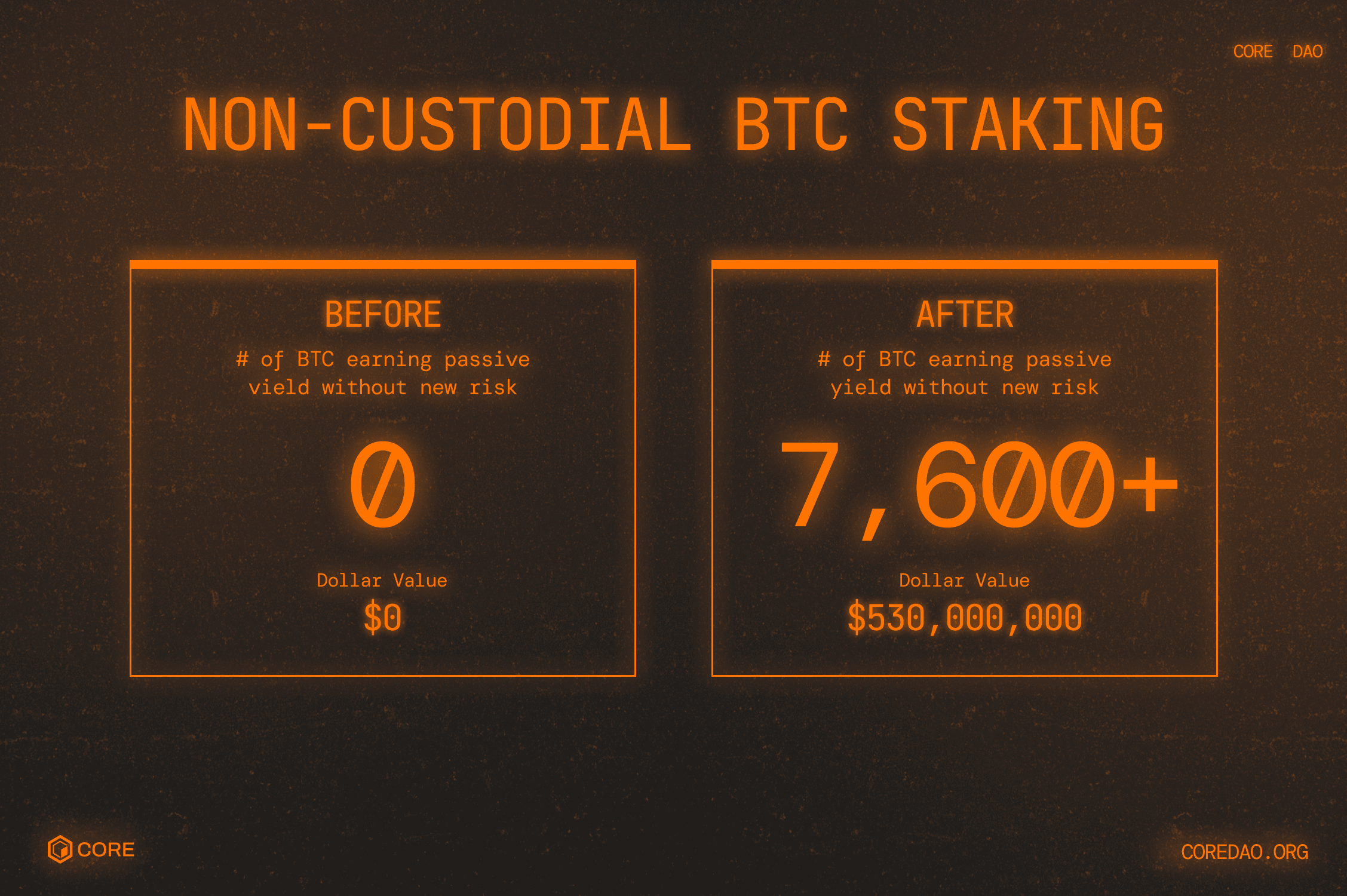

Non-Custodial Bitcoin Staking: Empowering Passive Yield Growth

Core Non Custodial Bitcoin Staking

A game-changer innovation in the industry. For the first time, Bitcoin holders were empowered with the possibility to generate yield without compromising control over their assets. This model quickly gained traction among both individual users and institutions, offering a sustainable, decentralized yield-generation option.

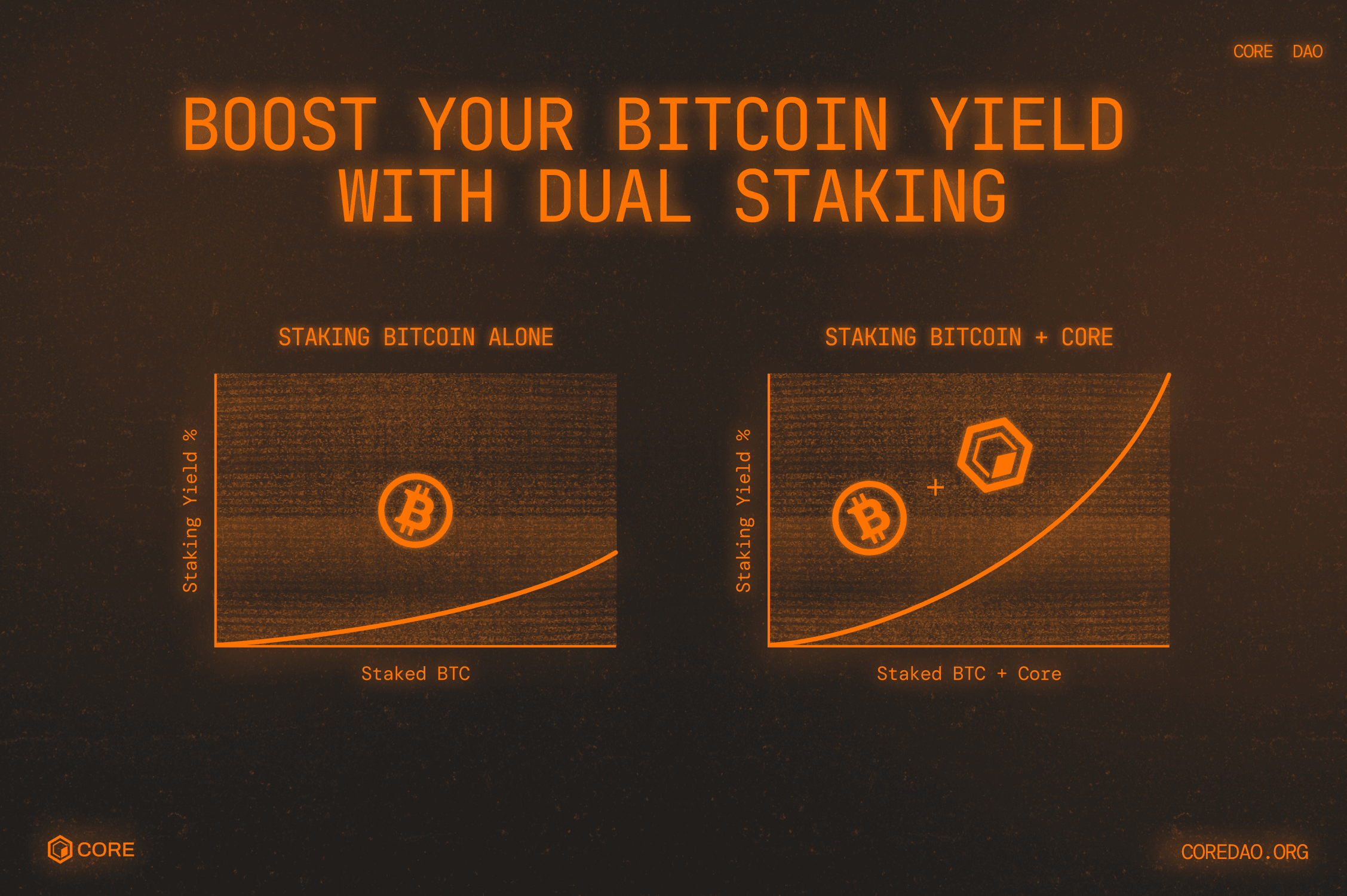

Boost Your Bitcoin Yield with Dual Staking on Core

Boost Bitcoin Yield with Bitcoin Staking

Wayne Tsu, contributor at Core DAO states that “Non-custodial BTC Staking played the biggest role in Core’s growth this year” while he works on Core’s Dual Staking model, which is also on the horizon, enabling yield on Bitcoin and CORE token while staking both and supporting long-term ecosystem sustainability.

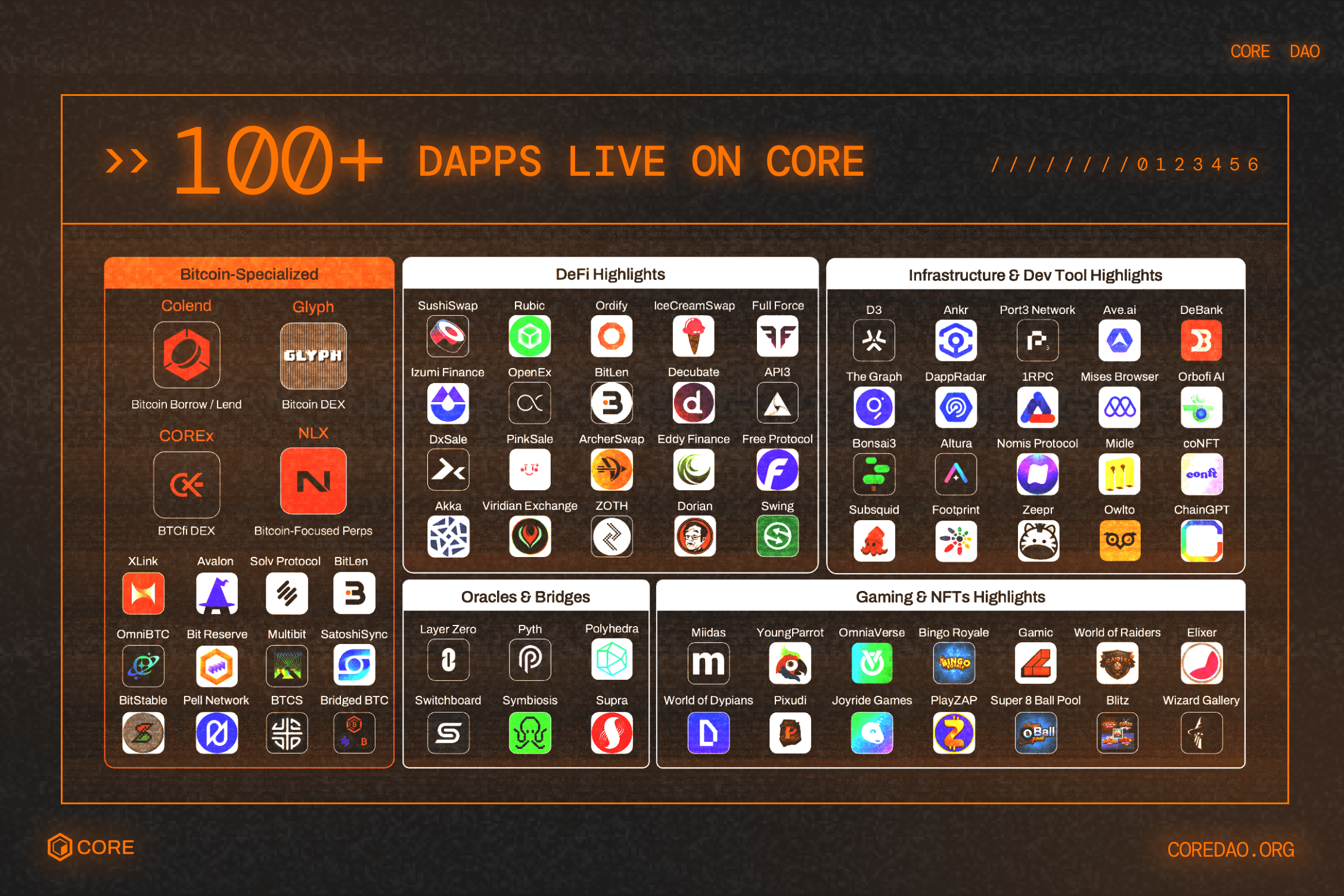

100+ DApps Now Live on Core Blockchain

Core DAPPS

Core’s ecosystem expansion has been another huge driver. It has integrated with DappRadar in early 2024, but since then, Core has already onboarded over 100 dApps spanning DeFi, gaming, and beyond, including launches like Glyph, Colend, NLX and COREx, just to name a few.

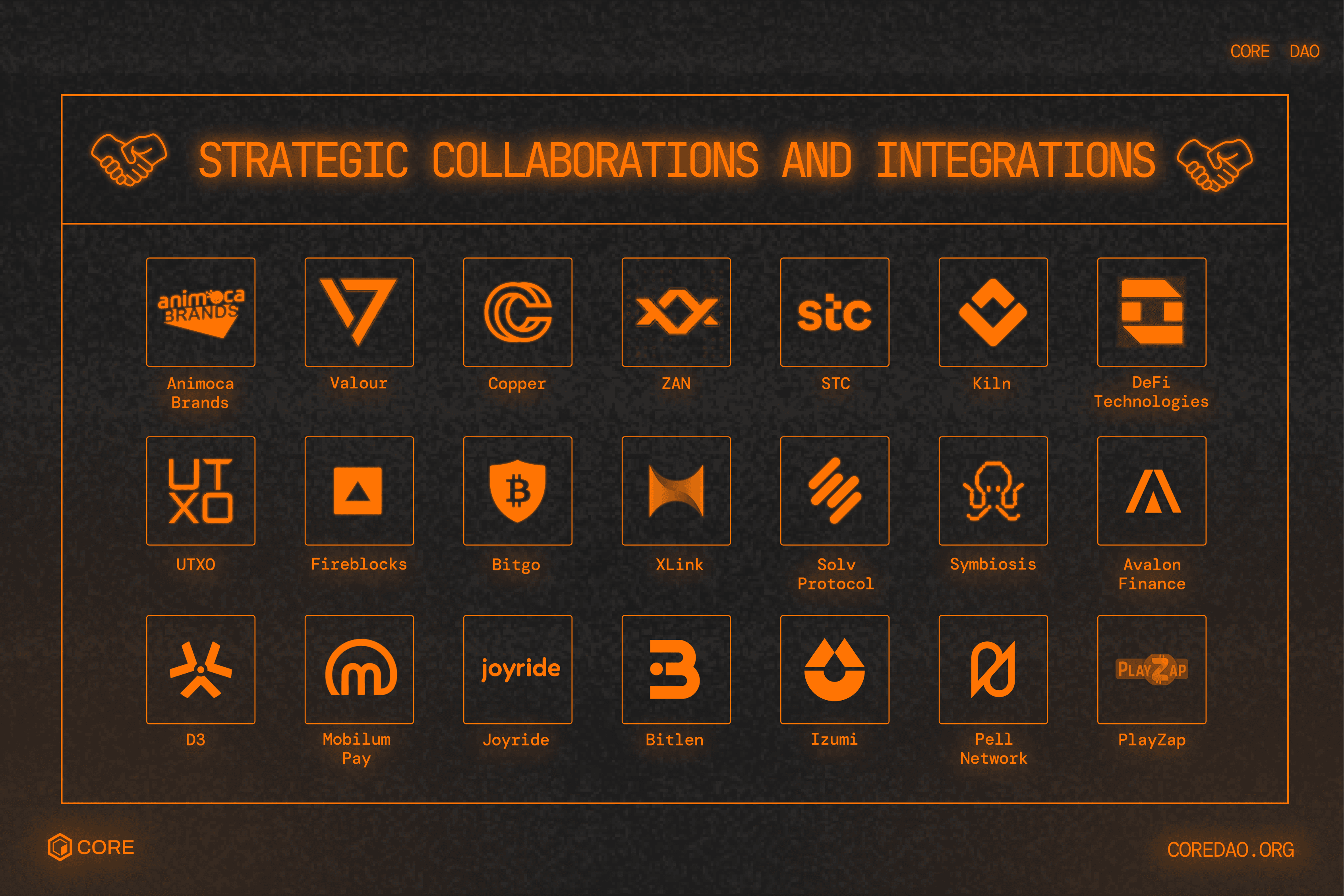

Strategic Collaborations and Integrations Driving Core’s Growth

6.png

CORE adopters, like Animoca Brands, Valour, Copper, ZAN, STC, Kiln, DeFi Technologies, UTXO and Fireblocks and integrations with protocols like Bitgo, XLink, Solv Protocol, Symbiosis, Avalon Finance, D3, Mobilum Pay, Joyride, Bitlen, Izumi, Pell Network and PlayZap, have brought a diversity of use cases to the network, ensuring accessibility and scalability for both developers and users.

Rich Rines states that: “Core’s Non-Custodial Bitcoin Staking is built for institutional adoption, offering yield on Bitcoin without introducing slashing risk, smart contract risk, or any additional trust assumptions. Valour Inc., a subsidiary of DeFi Technologies, recognized this early and launched the first-ever yield-bearing BTC ETP powered by Core. Following its success, Valour also introduced the first CORE ETP, becoming a major advocate for Core’s ecosystem. Leading custodians have since joined in to expand Core’s reach. Copper, a leader in Bitcoin custody and collateral management, integrated Core’s Bitcoin staking, unlocking wider institutional potential. Fireblocks, another prominent institutional digital asset platform, also adopted Core, enabling its clients to participate in Core staking and the growing BTCfi ecosystem.

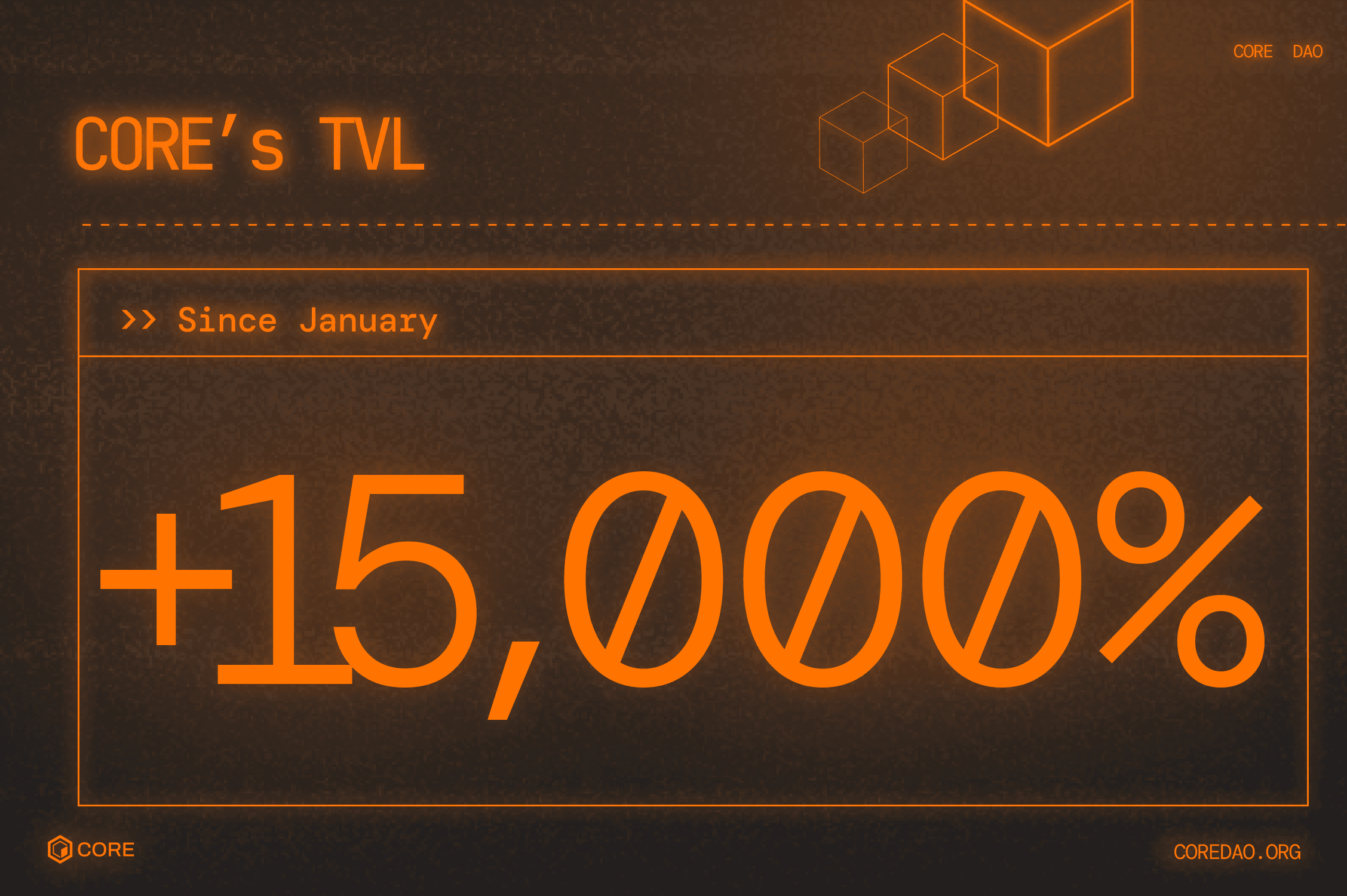

Core's TVL Growth: Achieving a 15,000% Surge Since January

7.png

These data points reflect the early stages of Core’s institutional adoption. Going forward, these key infrastructural starting points will pave the way to their institutional clients participating.”

Through these developments, Core has positioned itself as a resilient, trusted ecosystem for both retail and institutional participants, becoming the #1 Bitcoin sidechain, but Dylan Dennis adds a very important point to the reasons why Core surged in 2024: “The Core community can not be overlooked. You can tell this is different from other crypto projects, it is clear by the enthusiasm of the Coretoshis and Core DAO Contributors that this is a multi-decade project in the making.”

Core Ignition Drop: Incentive Program for the Coretoshis

Core Ignition

Rich Rines adds to it: “Core Ignition has truly ignited user engagement across the Core ecosystem. The numbers speak for themselves: DappRadar reports over 1.8 million unique wallets interacting with Core protocols in just the past week, with 26 million total addresses across the platform. Core is now handling hundreds of thousands of daily transactions, showing that Ignition has become more than just an incentive—it’s a gateway to Core education and a key driver of our explosive growth over the last year. Through Ignition, users have a clear path to discovering Core's capabilities, making it invaluable not only for building awareness but also for establishing a loyal, active community.”

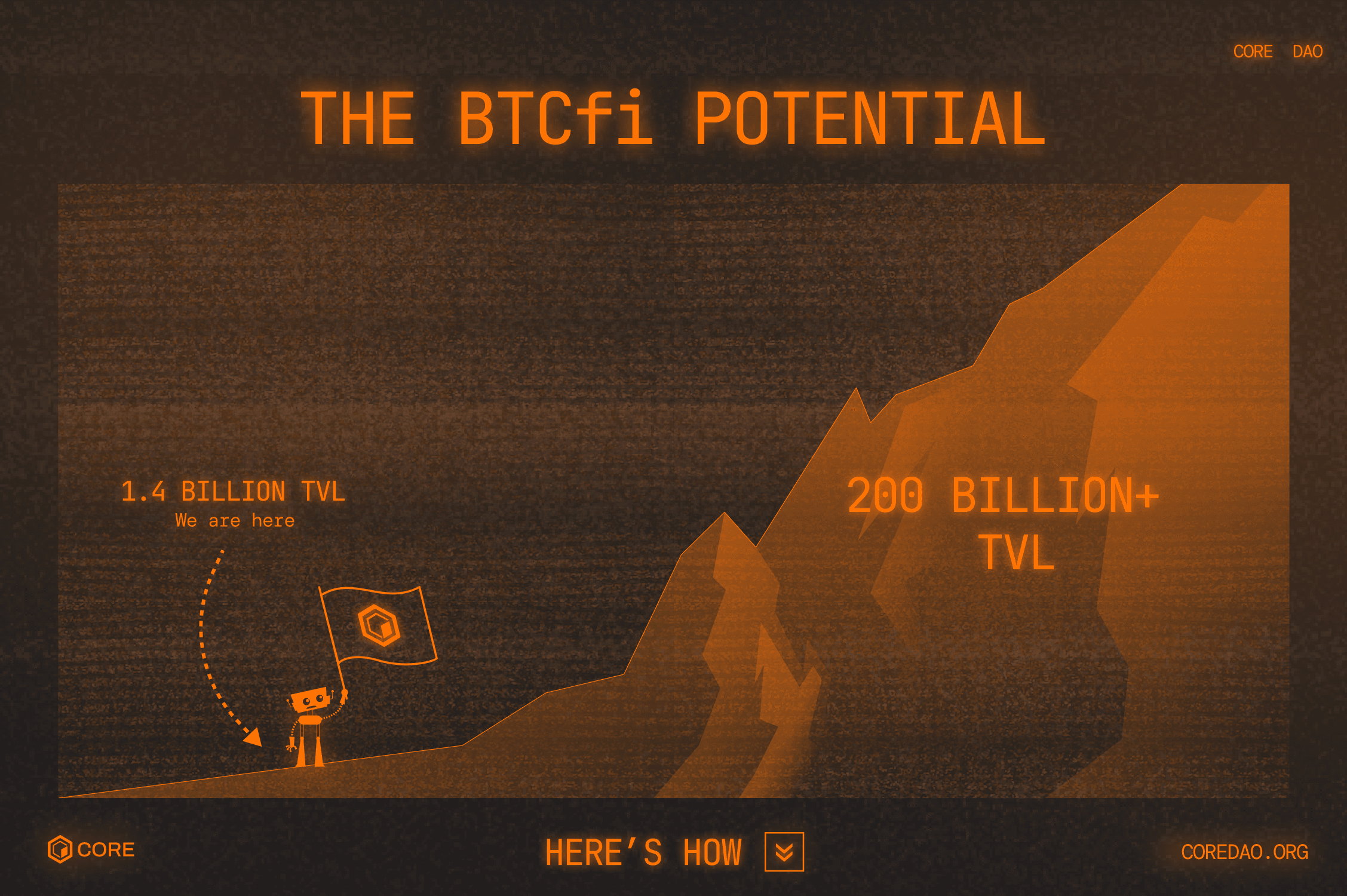

The BTCfi Potential: Unlocking a $200 Billion TVL Opportunity

9.png

By addressing high-security and self-custody standards, Core provides both users and institutions with low-risk, on-chain solutions for Bitcoin yield, bridging the gap between traditional finance and Bitcoin DeFi, with innovative offerings tailored to emerging market demands.

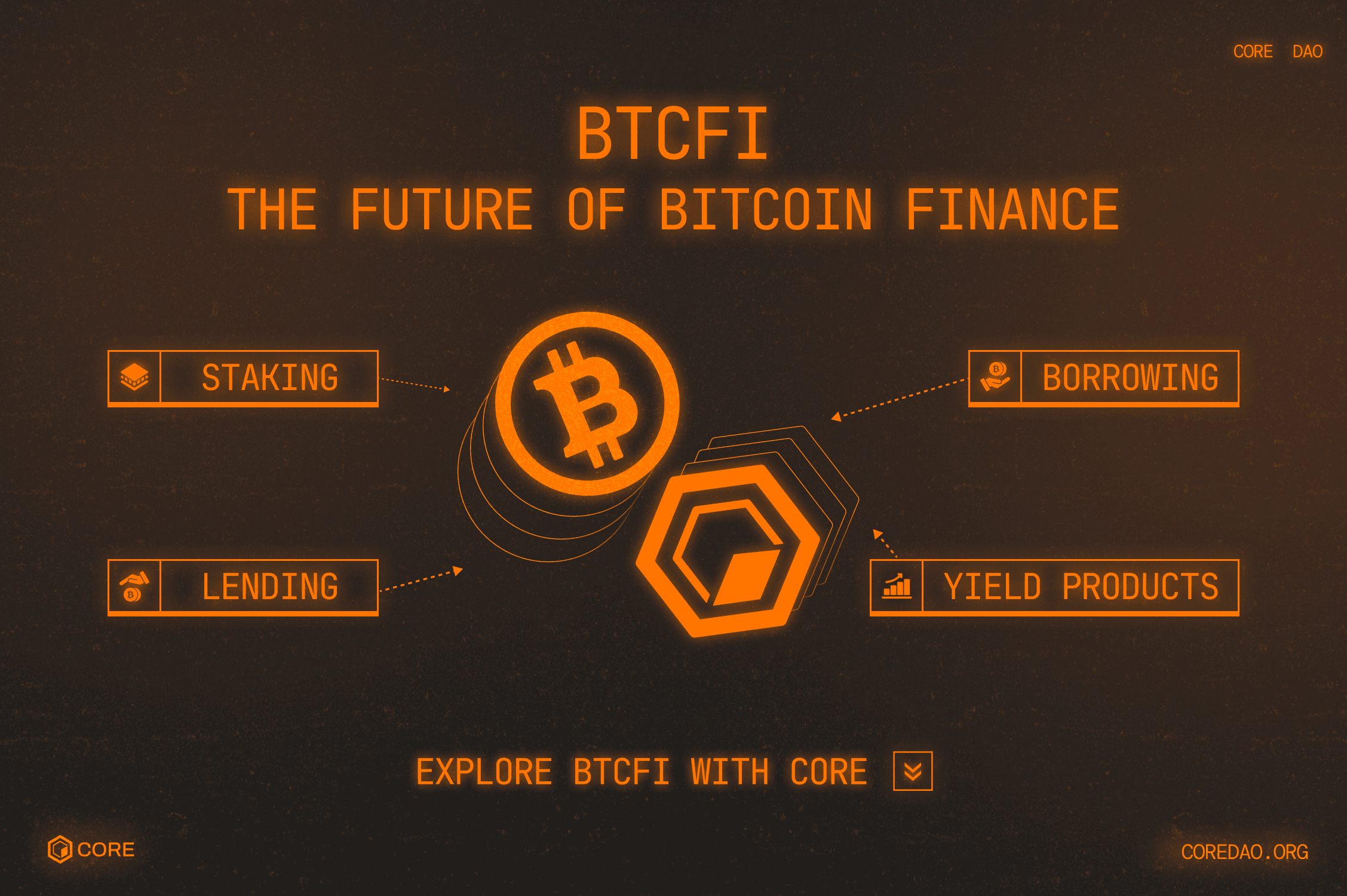

Innovation doesn’t stop here. Looking to the future, Core plans to unlock Bitcoin’s role in DeFi even further, by focusing on sustainable growth and innovative financial models. When asked about what is still left to unlock, Wayne Tsu answers promptly: “Bitcoin-backed Stablecoins.”

Rich Rines says that: “Bitcoin DeFi is just scratching the surface. Despite Bitcoin comprising half of the crypto market cap, only 0.1% of its value, around $1.6 billion, is currently locked in BTCfi. For perspective, if Bitcoin’s DeFi locked value mirrored Ethereum’s (~15% of its market cap), we’d be looking at a $200 billion+ opportunity—a staggering 130x+ increase from today. And if you’re bullish enough to envision Bitcoin surpassing gold’s market cap, then Bitcoin DeFi could easily scale into the $1 trillion+ range.”

BTCFi: The Future of Bitcoin DeFi with Core

Core: Future of Bitcoin DeFi

By continuously adapting to user needs and scaling Bitcoin DeFi offerings, Core is solidifying its place as a leader, ensuring Bitcoin’s place as a dynamic, sustainable tool and unlocking its full potential.

2025 is already in planning, and it promises to be another innovative year for Core. Rich Rines gives his closing remarks: “Trends in crypto come and go, but ultimately everything returns to Bitcoin. Being the most Bitcoin aligned chain is Core’s greatest superpower, because the two chains reinforce each other both in security and utility. Core makes Bitcoin a natively yield-bearing asset, gives Bitcoin miners supplemental income, and provides an aligned platform for Bitcoin to grow beyond a store of value. With the Fusion Upgrade, Core and Bitcoin become perpetually tied together. CORE is the key that unlocks sustainable Bitcoin staking yields.”

About Core

Core serves as the Proof of Stake layer for Bitcoin as the first enabler of Self-Custodial Bitcoin Staking, which secures a fully EVM-compatible BTCfi ecosystem. Since April 2024, over 7,200 BTC valued at more than $530 million have been staked with Core, enhancing Bitcoin’s utility and security. Core is the most Bitcoin-aligned EVM blockchain with ~76% of Bitcoin mining hash power contributing to the network’s security. This breakthrough has amassed millions of Core adopters - over 27M unique addresses, 308M+ transactions, and over $634M TVL since its mainnet launch in January 2023.